Choose the False Statement About a Homeowners Policy.

Get Other Homeowners Involved. Include water damage by flood sewer backup and underground seepage.

How Homeowner S Insurance Affects Your Mortgage Mortgage Tool Life Insurance Humor Umbrella Insurance Life Insurance Quotes

Dwelling coverage protects the structural components of your home from damage and covers in the event of damage to the home that impacts walls.

. HO-2 covers the dwelling and contents for the broad form perils. Identify the property that justifies it. HO-2 will pay for a broken pipe that has caused water damage.

Under the un-endorsed Homeowners Policy jewelry is covered up to what amount. If the following statement is false choose False Statement. Coverage A or dwelling coverage is the central coverage included in a homeowners policy and will generally have the highest limit of types of coverage on your policy.

The homeowners policy covers collapse caused by all of the following EXCEPT. Former Ice Cream Shop Owner Also Sued Over Use of Racist Intimidation Tactics Pulling Weapons On Peaceful BLM Protesters First Lawsuit Brought by AG James Hate Crimes and Bias Prevention Unit NEW YORK New York Attorney General Letitia James today took action to stop discrimination harassment violent threats and for the first time false race-based. Fortunately a homeowners policy will cover damage to your home and personal property due to a variety of causes called named perils in insurance lingo.

Damage to lawn furniture caused by vandals. Homeowners insurance gives you both property and liability protection. Stop yelling sit down etc they may follow if other homeowners repeat the direction to them.

It can be uncomfortable to get others involved but you can benefit from engaging your community. Choose the false statement about an Umbrella Liability Policy. Cover theft of furs and jewelry up to 1500.

Mortgage fraud also occurs when a homeowner gives a false statement explaining that the home that they are buying is their primary residence when they were actually looking to rent out the property as an investment. Types of property are not covered under Coverage C. Under Coverage C of a Homeowners Policy all of the following losses are included except.

Money is covered up to 500 per occurrence D. A binder will not end when the policy is issued Choose the false statement about the Homeowners Policy. Under an HO-2 the insured may rent hisher garage to the neighbor for a woodworking shop d.

HOA board and mainly the president has sent letters accusing me of various things over the past 5 years ie. Choose the false statement about the Homeowners Policy. Once you get approved for a mortgage on a home your lender will ask you to provide them with multiple documents so that you can officially close on the loanOne of these required documents is your proof of homeowners insurance which ensures that the home and in turn the lenders financial investment is protected from perils like fire and bad weather.

The personal liability portion of a homeowners policy provides coverage for example if your litigious brother-in-law slips down your steps on a rainy day and injures himself. After underlying coverage is exhausted this coverage is excess Specific minimum limits for underlying coverage are required Certain losses excluded by the primary policy are covered Property in the care and custody of the insured is covered. Choose the correct statement regarding the HO-3.

Coverage C extends to animals birds or fish owned by the insured. HO-2 pays for losses to the contents on an ACV basis. If one of the cancellation properties is being used to transform the equation identify the quantity that is added to or multiplied by both sides 89 Answer Selecting an option will display any text boxes needed to complete your answer G.

The limit of the equipment breakdown policy applies to property of the insured property of others and expediting expenses in any combination as long as expediting expense does not exceed 25000. Cover theft of guns up to 3000. Running a business out of my home parking in the middle of road giving out the gate code puttiing concrete in the lake taking too long to landscape charging me for a gate when it was done by another.

Contents are covered 100 worldwide c. All of the following are considered an insured under a Homeowners Policy The definition of insured includes other residents of the named insureds household who are. 1 Relatives of the named insured meaning they are related by blood or 2 Under the age of 21 and in the care of any insured.

The Ho-2 provides broad form coverage on both the dwelling and contents b. Choose the false statement regarding the coverage of property under a Homeowners Policy. Which statement is false of Homeowners policies.

If a bullying homeowner is continually disruptive and refuses to follow the directions of board members eg. Choose the false statement regarding the coverage of property under a Homeowners Policy. Windstorm damage to a riding lawnmower sitting outside the garage.

Coverage A Dwelling Coverage. Section II of all Homeowners Policies are exactly alike. Theft of silverware is covered up to 2500 C.

Choose the false statement about Coverage F in a Homeowners Policy. The Personal Property Replacement Cost Endorsement may be added to cover the contents on a replacement cost basis B. Coverage C extends to animals birds or fish owned by the insured Personal property owned and used by the insured in a vacation home would be covered Motor vehicles do not meet the definition of contents.

Cover money up to 500. Choose the false statement about a Homeowners Policy. Cover theft of furs and jewelry up to 1500.

Which of these is the best description of the special HO-3 homeowners insurance policy. 1500 for loss by theft. Which statement is false regarding a Homeowners Policy.

This allows the homeowner to get a lower interest rate on their loan but it is a false statement that constitutes mortgage fraud. Which form is designed for the unit-owner of a condominium. How to handle false statements by Board members of HOA.

Under Coverage F payments apply to necessary medical expenses incurred within a maximum of one year. HO-2 does not cover loss of fence driveway or walk caused by vehicle owned by insured. 1It offers extensive coverage for your home and also includes personal property and liability protection 2Its the most comprehensive policy available covering even flood damage.

What Is The Difference Between Ho2 And Ho3 Homeowners Policies

:max_bytes(150000):strip_icc()/modular-vs-manufactured-home-insurance-5074202_final-3c70b04af30a43c6ba0ba87089373bf7.png)

Modular Vs Manufactured Home Insurance

New Brunswick Vacation Property Weekly Rental Agreement Form Rental Agreement Templates Vacation Property Rental

18 Exhilarating False Ceiling Lighting Surround Sound Ideas 18 Exhilarating Fals 18 Exhilarating False Ce Surround Sound Ideas False Ceiling Ceiling Lights

Best Homeowners Insurance In Louisiana Valuepenguin

Sample Vehicle Release Form Examples Word Pdf Authorization Letter Collect The Driving License Printable Lettering Letter Templates Word Doc

Questions From Sellers To Real Estate Agents Realty Times This Or That Questions Real Estate Real Estate Agent

Commercial Auto Insurance Covers Damage Or Theft To The Vehicles In Your Fleet As Well As Any Bodily Injury Or Prop Business Insurance Insurance Bodily Injury

Chapter 5 Homeowners Policy Flashcards Quizlet

Best Wrongful And False Accusation Quotes And Saying In Relationship Accusation Quotes False Accusations Quotes Adulthood Quotes

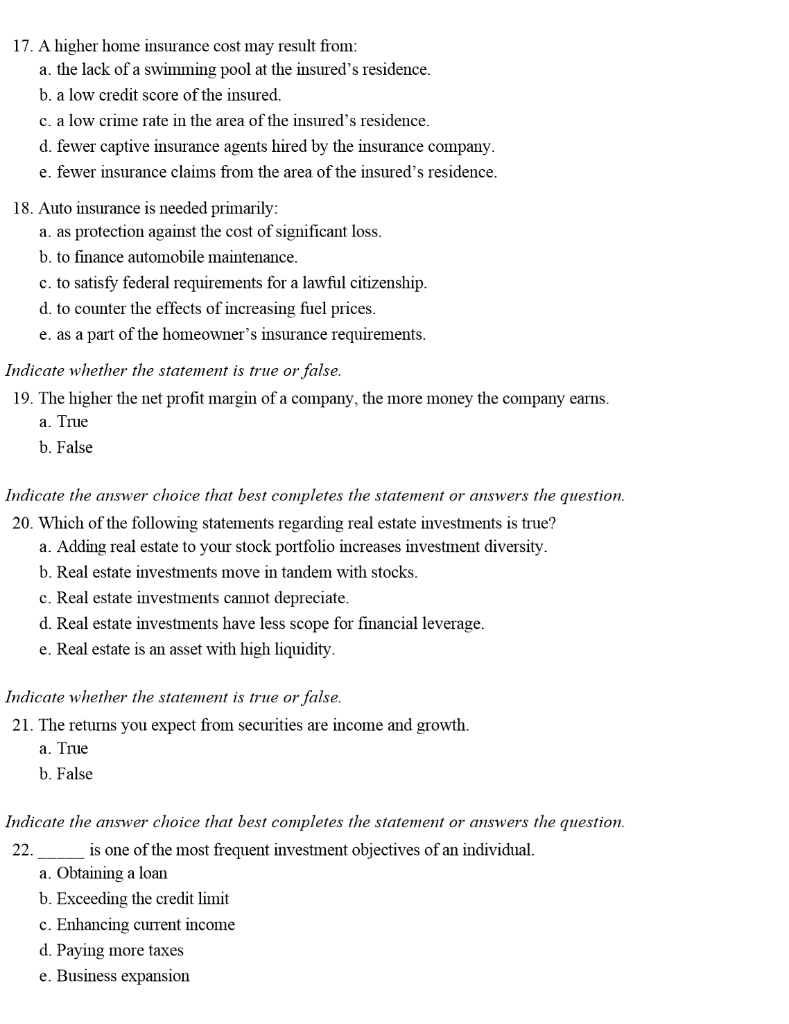

Solved Indicate Whether The Statement Is True Or False 1 Chegg Com

16 Most Important Car Insurance Terms Infographic Car Insurance Car Insurance Tips Insurance Marketing

Off Property Accident Insurance What To Know Trusted Choice

Free Photo Realtor Giving Keys To New Owner Homeowners Insurance Florida Insurance 30 Year Mortgage

Comments

Post a Comment